Through the third quarter of 2017, the venture capital market saw an average deal that invested more money into larger and older companies than in prior years. With fewer exits and deals occurring throughout the industry — as well as a historic $90+ billion in uninvested capital (aka “dry powder”) — a reasonable expectation might be that funds would have a difficult time raising capital. In fact, fund raising, while likely to finish behind 2016, is set for another straight year with greater than $30 billion raised, and this money is going into more funds with an overall increasing fund size.

Fund managers are having a historically easy time raising capital, with more than 90 percent of funds closing at their target goals, according to the PitchBook/National Venture Capital Association Venture Monitor. In total, 157 funds have closed on $24.4 billion in capital, and more than 50 percent of funds raised more than $50 million. Even first-time funds appear to be embraced by investors: 2017 has already seen as many first-time funds (25) as in all of 2016, raising $2.4 billion to date.

Fund managers raising a follow-up fund are particularly successful to date in 2017. These raises are seeing a median increase of 1.5x relative to the previous fund, well above the historic rate of 1.1-1.2x. The median time between these raises has increased slightly over the most recent years, although the 2017 median of two years is briefer than the 2.6-3.2-year window that existed from 2008-2013.

The shortened time between successful, larger raises is surprising for two reasons:

First, as discussed last week, exits are decreasing and the length of time before companies exit is increasing. These trends provide fewer opportunities for investors to experience returns — and for managers to demonstrate success. Indeed, a PitchBook report from earlier this year finds that no median fund since at least 2002 has provided a realized return (based on distributed-to-paid-in ratios, residual value ratios have been above 1.0x most years).

In addition to the lack of return activity, a second reason fundraising success is surprising is that funds are sitting on more than $90 billion in dry powder. This amount is almost 50 percent greater than all VC investments to date in 2017 ($61.4 billion) and is three times larger than the amount raised to date this year.

Clearly, the appetite for VC investment opportunities far exceeds what at least fund managers are seeing as the actual investment opportunity.

Setting aside a range of hypothetical explanations based on a psycho-analysis of American media and culture, PitchBook recently provided a potential explanation of the fundraising phenomenon: the venture capital market is the last source of yield in what is likely another bubble economy.

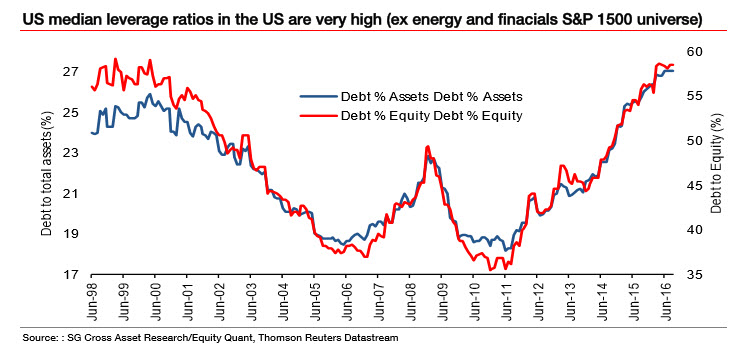

Their analysis points to low bond yields and capital costs that are leading to a repeat of the debt-to-asset ratios seen around the time of the last two downturns in the American economy. The increase in these ratios are evidence that companies find capital to be very inexpensive. Of course, the reverse side of low-cost capital for companies is that investors cannot experience strong returns, prompting an interest in riskier assets, such as VC.

Thus far, the deal trend data suggest that fund managers are responding to their surplus of capital by making bigger bets on companies that are older and revenue-generating, i.e. safer.

Another result that could (and, perhaps, should) occur as a result of this capital build-up is more funds seeking investments that are overlooked by the bulk of the VC market. Investors looking to see their capital actually deployed to companies should be interested in funds that are willing to find value away from Silicon Valley. To this point, Crunchbase has found anecdotal evidence of a rise in Midwestern funds, but observers will need to wait until more 2017 data is available to determine whether this is a sign of a meaningful trend.