The U.S. Department of Treasury released its final annual report for the State Small Business Credit Initiative (SSBCI), which provided funding to states for lending and investment programs. “Venture capital” programs, often structured for pre-seed (13 percent of funds), seed (27 percent) or early stage (45 percent) investments, attracted $4.2 billion in immediate private financing against $327 million in federal dollars. This leverage of $12.76 of private investment for every public dollar was further improved by more than $2 billion in subsequent private financing to date. Perhaps more significant than the program’s ability to attract private investors has been its success in generating investments outside of the nation’s most concentrated markets.

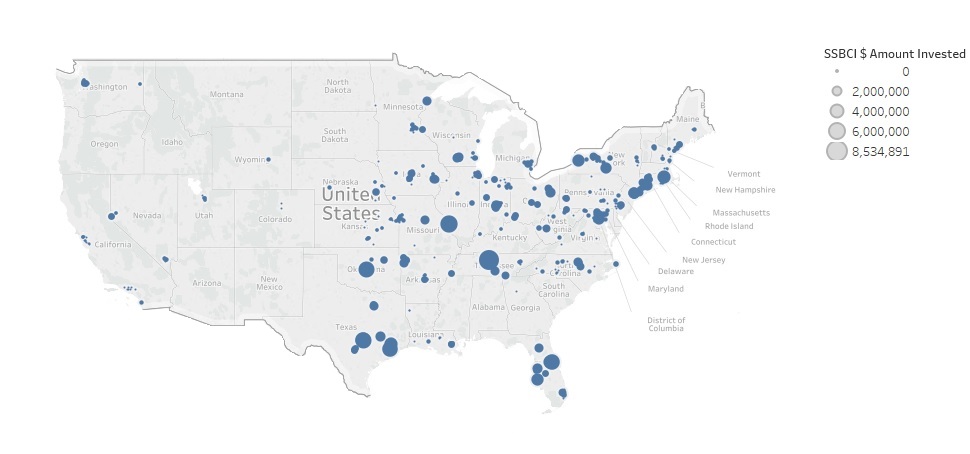

The figure below maps SSBCI-related VC investments, and some of the strongest users were Arkansas, Hawaii, Indiana and Missouri. Results further indicate that programs were successful in encouraging in-state investors, with angels and in-state funds being the most common co-investors. SSBCI sunset at the end of 2016, and there is no current Congressional activity to renew the program. SSTI supports the implementation of a related initiative built on lessons learned from SSBCI in our policy platform.

Map of SSBCI Venture Capital Investments, 2011-2016

Note: The Municipality of Anchorage, Hawaii, and Puerto Rico also expended SSBCI funds in VCPs, totaling $1.3 million, $5.2 million, and $1 million, respectively.