Note: Every profession has jargon. Practitioners of technology-based economic development know the field may have more than its fair share of words and acronyms as it bridges numerous scientific and engineering disciplines, business and financial acumen, and public-private initiatives at all levels of government supporting regional innovation. This occasional series from the SSTI team provides introductions or reminders of some of the key concepts used across the practice. ~ Mark Skinner, SSTI President & CEO

Understanding and using Technology-Readiness Levels to guide innovation finance strategies. Early-stage companies often have unproven technologies, products, business models, and teams. However, technology development and investor interests are more likely to align when the technological innovation can create value at a level of risk acceptable to the investor. So, how do we understand how well developed a company needs to be for investors to be comfortable? Companies that have entered the market can often point to customer growth and revenue figures. But what framework can we use to communicate a company’s technological progress and broadly assess the future needs and risks of one opportunity against others?

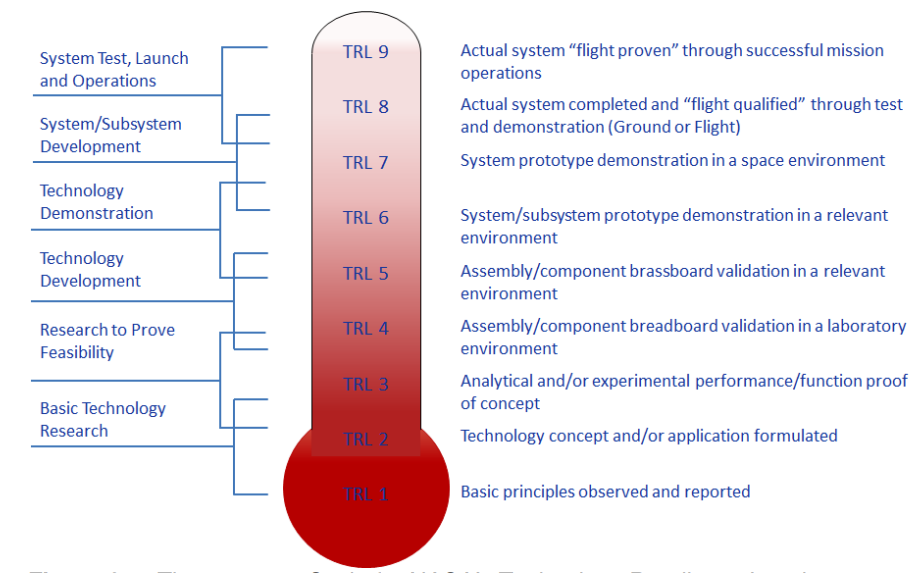

One solution for understanding development across highly varied technologies is Technology Readiness Level (TRL). TRL originated in the 1970s when NASA recognized the need to consistently communicate the maturity of a wide range of technologies under development for spaceflight. TRL is a nine-level, technology-agnostic scale for quantitatively describing the development progress and pathway for new technologies needed to meet mission objectives.

Figure 1 describes the TRL scale levels. The earliest levels cover basic research and concept development. The mid stages move through feasibility testing, prototype development, and demonstrations. The last stages complete testing and ready the technology for its intended use. As such, the top end of the scale only represents technologies that are “mission ready,” a level that roughly equals product launch in a startup environment. For companies, this top end of the scale is still early stage, and they require significant funding to launch, market, and scale what has been developed.

Figure 1. NASA Technology Readiness Level (TRL) scale. Image credit: NASA SP-20205003605 TRA BP Guide Final

While the TRL scale has been adopted by other federal research agencies and the private sector, it has not seen as widespread use by early-stage investors and across many TBED programs. For TBED policy makers and practitioners, TRLs can help direct program design and right-size outcome expectations achieved from the TBED assistance. Applied in the startup environment, from an investor perspective, the underlying reality of immature technology having higher total costs, longer timelines, and more unknowns is intrinsically linked to investor decisions. Many investors will want to see market validation or minimum viable product (MVP) testing that could equate to TRL seven or eight. Even the earliest-stage investors often want to see technical validation, which equates to technologies at levels five or six.

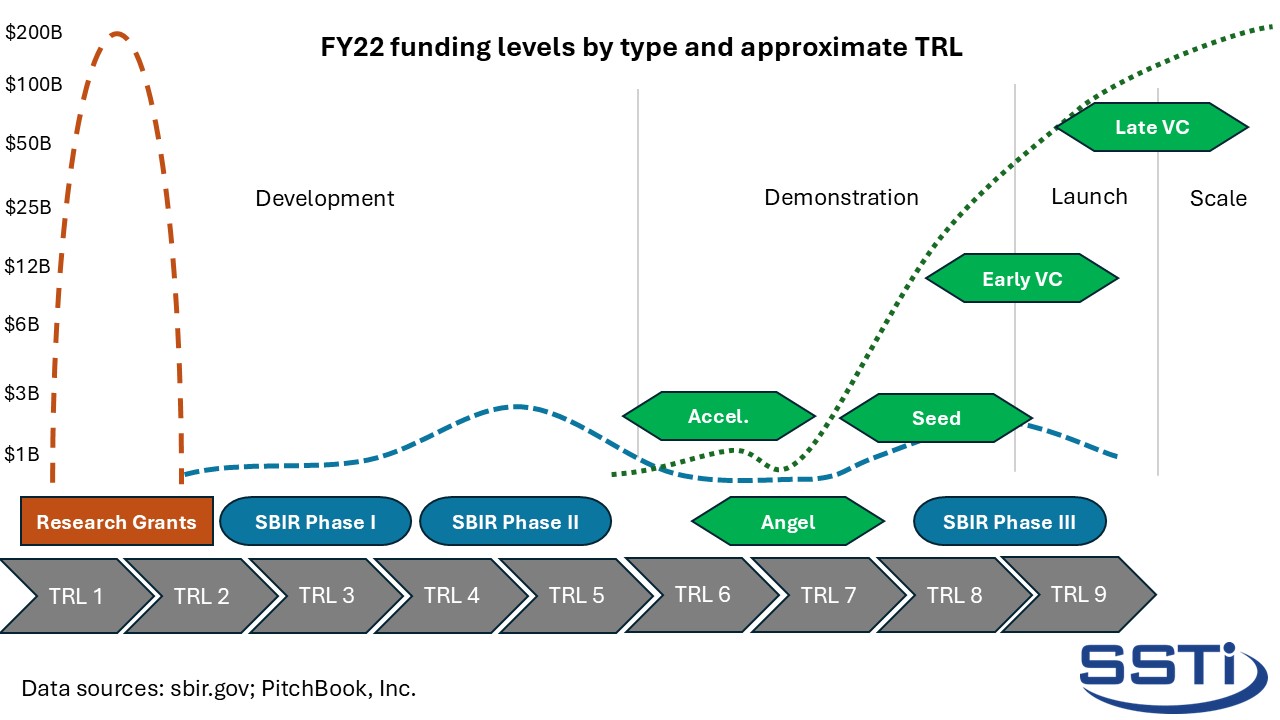

Private investors moving downstream in search of more mature technologies and stronger business models leave gaps in the market and limited resources for companies to complete pre-market R&D activities. While there are some resources available to early-stage companies to support technology development, they pale in magnitude of spending compared to those for basic research and later-stage market capital. Figure 2 shows funding levels tied to both sources and stages of technology development, highlighting the distinct funding trough in the middle stages of the TRL scale. Even companies with funding options at TRL 2-6 are at risk of protracted timelines and insufficient resources to optimize their approach, both of which can jeopardize access to later-stage investment.

Figure 2. Technology Readiness Levels and associated FY22 funding levels for federal research, SBIR/STTR, and private sector funding.

SBIR/STTR provides one example of a public intervention that has proven repeatedly to be extremely valuable for companies developing novel solutions, though even these federal resources do not address all funding challenges. Companies that successfully secure SBIR/STTR awards, particularly Phase I, are often viewed as too early for angel and seed fund investment. Even companies with successful Phase II awards may not have answers to the business model questions necessary to secure later-stage or larger investments. Of course, not every technology aligns with federal priorities, and many companies are unable to access the highly competitive SBIR/STTR programs.

Conversely, accelerator programs invest in early-stage companies, though they are more often focused on business model acceleration over technology development. Many angel investors and venture capital funds are likely to hold off until companies have moved key technologies to TRL 7-9 and validated key business assumptions. These constraints, coupled with broadly declining early-stage and smaller deal activity, can lead to real funding challenges for many of even the most promising companies.

Fortunately, well-designed state and regional TBED programs fill these gaps in public and private markets by strategically leveraging the limited resources available to move local companies along the TRL scale and toward market-based funding. Public, public-private, and mission-focused funding for early-stage tech companies can target gaps in specific markets and effectively help companies reach critical milestones and additional resources. One key to success for these programs is working within the target market to overcome limitations and capitalize on opportunities simultaneously.

For economic developers, there are potential policy advantages to incorporating TRL into program design. As a communication framework, explicitly connecting programmatic rationale and criteria to funding gaps across TRLs may help to solidify stakeholder backing. Links to distinct phases of development can also help companies and external investors understand the eligibility and decision-making process for TBED programs.

The TRL scale is a communication tool, not a road map for technology development. Companies will need to complete all the steps, but some steps will move quickly while others may stall. Each technology and company faces a unique journey. Where TRLs become valuable for TBED is as an assessment and communication tool to support program planning, funding, activity, and impact.

Does your organization or your external partners utilize TRL in program and funding decisions? If you are interested in learning more about tools like TRL and other best practices for developing and managing programs, please join our TBED Community of Practice to share your experiences and learn from others making an impact in communities across the country.

This page was prepared by SSTI using Federal funds under award ED22HDQ3070129 from the Economic Development Administration, U.S. Department of Commerce. The statements, findings, conclusions, and recommendations are those of the author(s) and do not necessarily reflect the views of the Economic Development Administration or the U.S. Department of Commerce.