Adding to the debate about whether smaller or larger businesses play an outsized role in the nation’s economy, a new Census Bureau report finds that the concentration of both older and larger firms has continued to increase in the U.S. economy over the last several decades, giving these firms an overall greater impact on employment and job growth than younger and smaller firms. Specifically, the report indicates that decreases in the national share of startup firms over the last several decades lead to an increased concentration of older firms, which in turn has had a greater impact on national employment and job creation than an increase in larger firms over the same period.

Analyzing the Census Bureau’s own extensive Business Dynamics Statistics (BDS) dataset (including annual measures of establishment openings and closings, firm startups and shutdowns, and job creation and loss from 1978 to 2019), Bureau economists evaluated firms based on two age categories (young and old) and two size categories (small and large). Young firms are those with positive employment for five years or less, and old firms are those with positive employment for more than five years. Firm size is based on “the first-quarter employment of a given year and includes all establishments associated with the firm at that time.” Large firms are those with 100 or more employees, and small firms are those with fewer than 100 employees.

Age

The first major trend identified in the report is that employment has grown more concentrated at older firms (those with positive employment for more than five years) over the last 40 years, seemingly contradicting the theory that younger startups are the primary drivers of employment and job growth. However, the report then shows that newer firms generally create jobs at a faster rate, which seems to contradict the previous observation.

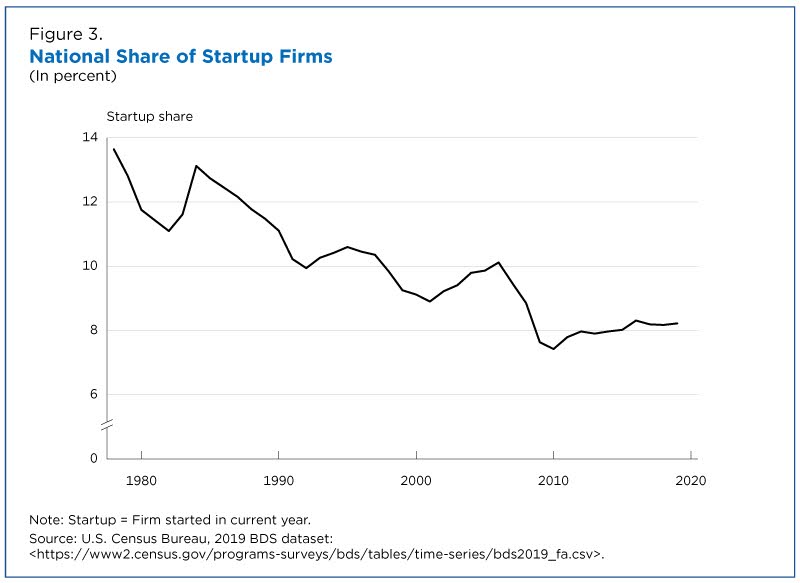

This discrepancy between younger firms growing at faster rates and older firms accounting for an increasing share of employment is due to the national share of younger startup firms decreasing over the last several decades as seen in the image below. So, although newer firms tend to grow and create new jobs faster, they have not been able to create a total number of jobs great enough to outweigh the economic impacts of older firms.

Size

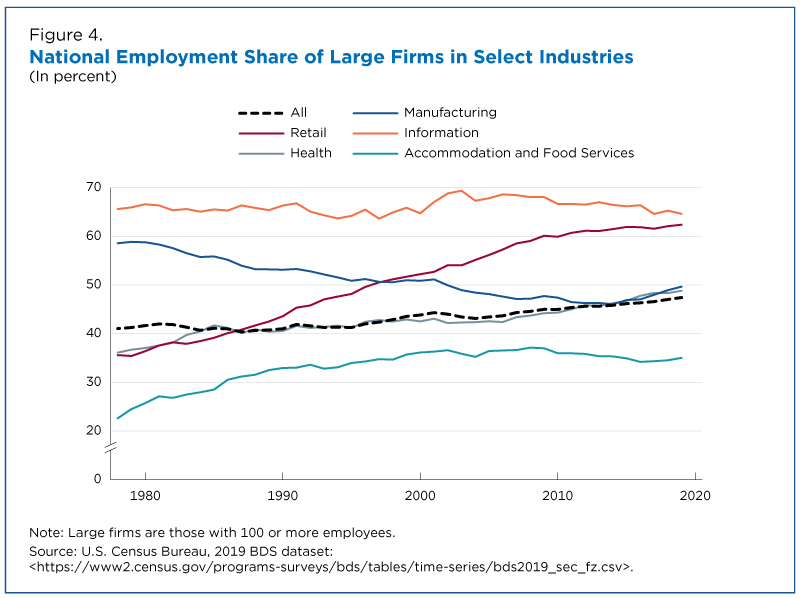

The report also finds that employment has grown more concentrated at larger firms (those with 100 employees or more) over the last 40 years, although the authors concede the national numbers conceal a considerable amount of variation at the industry level. For example, employment in the manufacturing sector has defied the national trend and has grown more concentrated in smaller firms, while the concentration of employment in larger firms has been most pronounced in the retail sector as “megafirms” continued to dominate markets. Additional state-level details on net job creation by establishment size and industry can be found in previous SSTI analyses of the BDS data.

Size or Age?

The report concludes that between the concentration of older firms and larger firms, the age of firms has a greater impact on job creation and employment than on size alone. This is because small firms outpace large firms in job growth, but not by nearly the same margin as old firms outpace new firms. Although job growth rates are an important measure of economic dynamism, total employment is often what ultimately drives policy, and as seen in the image below, older firms continue to clearly account for the lion’s share of US total employment.