Our future prosperity will always require innovation. What is TBED?

Innovation requires an openness to the possibility of doing things better.

Entrepreneurship is the urgent willingness to try.

~ Mark Skinner, SSTI President & CEO

For America's global competitiveness, our federal, state and local prosperity policies should increase the likelihood of success for more high-impact enterprises capitalizing on scientific and technological innovation. Technology-based Economic Development (TBED) is the field of policy and practice addressing this critical need. TBED is the bundle of public-private policies and programs that use scientific discovery, technology development, and creativity to move innovation through the formal and informal networks, organizations, institutions, and community that collectively comprise a regional innovation system.

TBED differs from conventional economic development by encouraging local growth based on innovation that, if the regional innovation system is working smoothly, can sustain economic opportunities for the region well beyond traditional strategies focused heavily on business/industrial recruitment and retention. TBED places stronger emphasis on creating new opportunities by nurturing the region’s innovation capacity or system, rather than recruiting companies from other regions.

TBED Community of Practice upcoming free webinars!

Lab-to-Market: Navigating the DC Innovation Landscape

March 10, 2:00 p.m. EST

Christon Hill of Georgetown Tech Ventures will tell us about the work and the unique innovation ecosystem in Washington, DC. Following Q&A, we'll have an open discussion about issues facing the technology commercialization community.

Register here.

Innovation Finance: How GRA Ventures grew to be one of Georgia’s largest VCs

March 12, 2:00 p.m. EST

Join us for an enlightening conversation with Connor Seabrook of the Georgia Research Alliance and the GRA Venture Fund. Connor will discuss the successes and lessons learned from GRA's long history of leading company formation and early-stage investment in Georgia. This is a great session to hear about working with universities, public-private venture funds, debt programs, and statewide entrepreneurship support efforts.

Register here.

Entrepreneurship Development

March 18, 2:00 p.m. EST

This month’s call will feature Nancy Lowery from the Medical Center of the Americas (MCA) Foundation's Innovation Center. Nancy will share an overview of the Innovation Center's work supporting biomedical and health tech startups in Texas, including how they approach company recruitment and outreach to build out their ecosystem. Her presentation will be followed by questions and open discussion.

Register here.

Unlocking Entrepreneurial Potential: A conversation with Professor Albert N. Link and Professor Donald S. Siegel, recipients of the 2026 Global Award for Entrepreneurship Research

April 8, 2:00 p.m. EST

During this session, we’ll examine the foundational contributions of Albert Link and Donald Siegel to technology transfer and innovative entrepreneurship, specifically their work unlocking the entrepreneurial potential of universities and public institutions.

Register here.

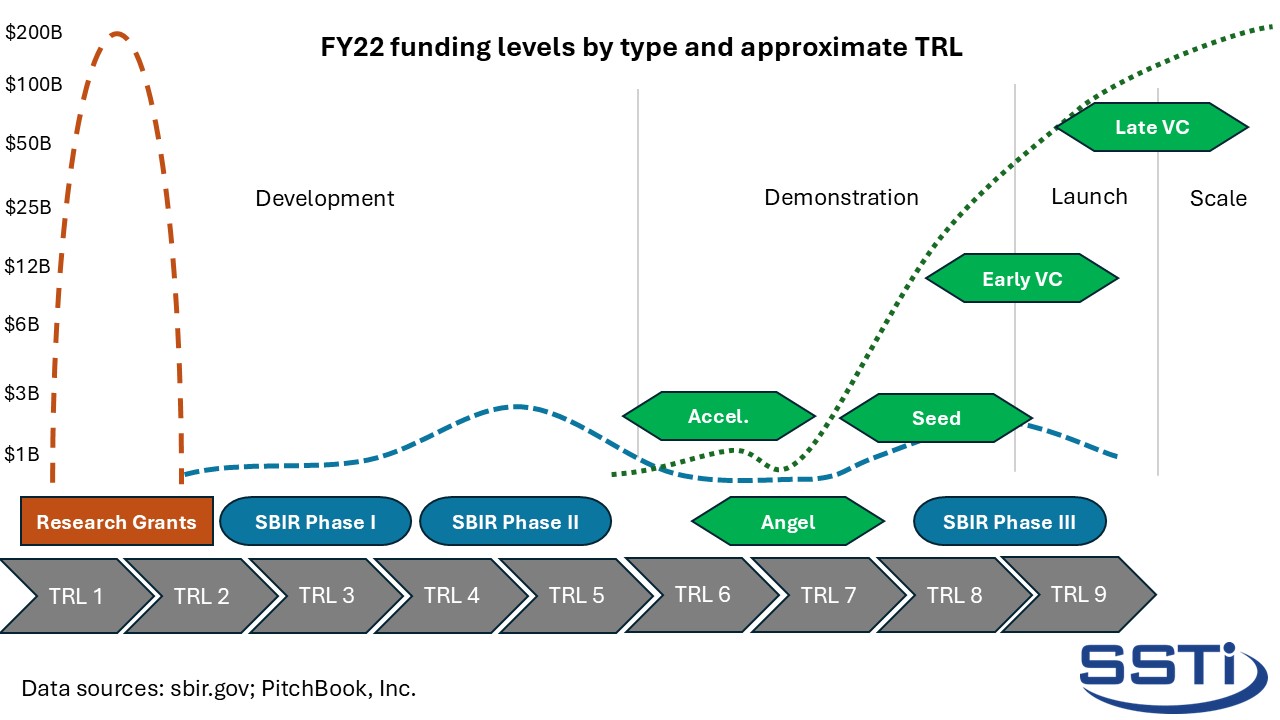

TBED 101: Technology readiness and market funding gaps point to need for TBED support

Understanding and using Technology-Readiness Levels to guide innovation finance strategies

Early-stage companies often have unproven technologies, products, business models, and teams. However, technology development and investor interests are more likely to align when the technological innovation can create value at a level of risk acceptable to the investor. So, how do we understand how well developed a company needs to be for investors to be comfortable? Companies that have entered the market can often point to customer growth and revenue figures. But what framework can we use to communicate a company’s technological progress and broadly assess the future needs and risks of one opportunity against others?

Why focus on state & regional innovation systems?

Regional innovation systems across the country vary greatly in structure, effectiveness and efficiency at moving innovation into practice or commercial production. The overall success of a regional innovation system depends upon the quality of the individual assets within the particular region and the linkages between these elements locally and globally.

Sometimes regions require a little support.

Regional innovation systems often ignore local political boundaries. Instead, the constituent elements in an effective regional innovation system draw on participation from all aspects of a regional community (private, government, education, research, philanthropic, financial, civic, etc.). Innovation economies emerge, they are not made. Recognizing this distinction is a defining quality of using a systems approach to support innovation and regional prosperity.

Vibrant innovation economies require collaboration across public, private and nonprofit partners.

The specific character, culture and vibrancy of a regional economy emerges from the interplay of many dynamic, complex adaptive systems. Disruptions are a part of the process.

A well-designed regional innovation support system is but one set of actors to restore and sustain prosperity.

Bottom line: the effectiveness, efficiency and resilience of most regional innovation systems can be improved through public policy, program investments, and other strategic interventions. SSTI is here to help.

Useful Stats: Higher education R&D expenditures and intensity by state

Higher Education Research and Development (HERD) expenditures grew in every state between Fiscal years (FYs) 2010 and 2024, rising 92% nationally over the 15-year period. However, when you adjust for inflation, five states and Puerto Rico instead experienced a real decline in HERD expenditures. Despite this broad growth, HERD expenditures remain highly concentrated, with five states having accounted for nearly 40% of all higher education R&D expenditures nationwide in FY 2024.

When measured relative to state economies, disparities are even more pronounced; nationally, HERD expenditures totaled 0.40% of gross domestic product (GDP) in FY 2024, a level of intensity largely unchanged over the past decade. At the state level, however, HERD intensity ranged from 1.21% in Maryland to 0.10% in Puerto Rico, with several large economies—including California, Texas, Florida, and Washington—falling below the national level.